PcMars

Farm Accounting Software For Windows

PcMars For Windows

This is the full-featured system, which can be installed as a cash basis, which is a single entry system, or a fully accrual double-entry system. The cash system is a simpler and easier to use, whereas the accrual system will handle more complex accrual accounting methods. The accrual system is capable of generating cash basis reports, dependent upon the method of inventory adjustment entries.

Both the Cash and the Accrual methods in PcMars have payroll capabilities with detailed payroll tax reports. Payroll checks can be printed with a detailed stub.

Software Features

Checks / Expenses

Deposits / Income

Revolving Credit

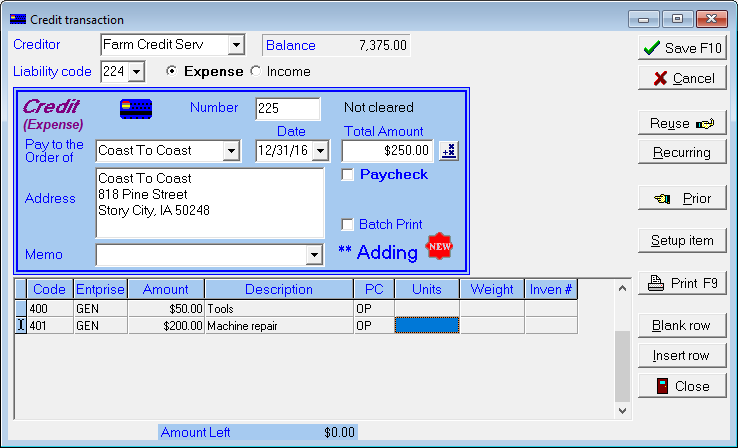

Revolving Credit transactions are usually used to enter any type of credit transactions and can be either expense or income. The primary purpose of a Credit Transaction is to track transactions paid through a revolving credit account such as credit cards or other loan instruments. It is similar to a check except that the money is coming from a loan vendor rather than a bank. These transactions will print on the reports as a deductible cash expense.

Reconciliation

When you receive your bank statement or revolving credit statement (credit card or Farm Service), either go to Transactions → Reconcile or click on the red check mark icon on the tool bar. After you do this, you will be asked which month you want to reconcile. Choose the appropriate month, which will be the bank statement month.

Payroll

Both the Cash and the Accrual methods in PcMars have payroll capabilities with detailed payroll tax reports. Payroll checks can be printed with a detailed stub.

User will enter the employer and employee information under the payroll setup screens. Once payroll is set up, entering payroll checks will be a simple procedure and is very similar to the checks/expense transactions. User will choose Paychecks from the transactions menu.