PcMars Advanced Payroll

Payroll enhancement to PcMars or PcMars PLUS

PcMars Advanced Payroll

Payroll enhancement to PcMars or PcMars PLUS

The Advanced Payroll module is an enhancement to the payroll already in PcMars/PcMars PLUS.

The Advanced Payroll Module includes:

- Federal Tax Tables

- State Tax tables for Iowa, Illinois, Minnesota and Michigan

- Ability to customize an additional seven labor withholding fields for a total of 10

- Ability to customize an additional six pay units, such as hourly (daytime), hourly (evening), miles, etc for a total of seven.

- Ability to track money loaned or advanced to employees through paycheck deductions.

- Ability to calculate retirement deductions and matching (in the non-simplified payroll method)

- Pension withholding calculation wages can be automatically adjusted by subject to tax preference for all 10 paycheck withholdings.

- Labor reports expanded to include the items above.

Software Features

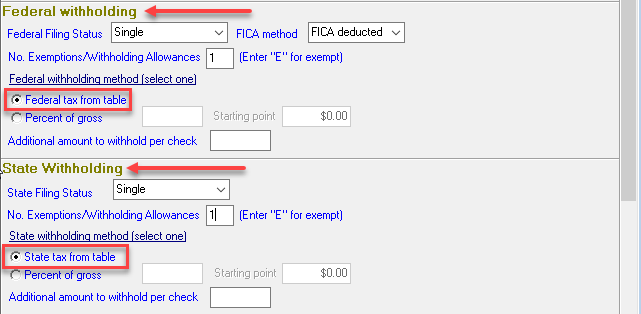

Federal & State Withholdings

The Federal and State tax tables are built into the Advanced Payroll module. If Federal and State Tax from table is selected on the setup screen, the federal and state tax is calculated from a tax table based on pay, pay per period, filing status and number of exemptions.

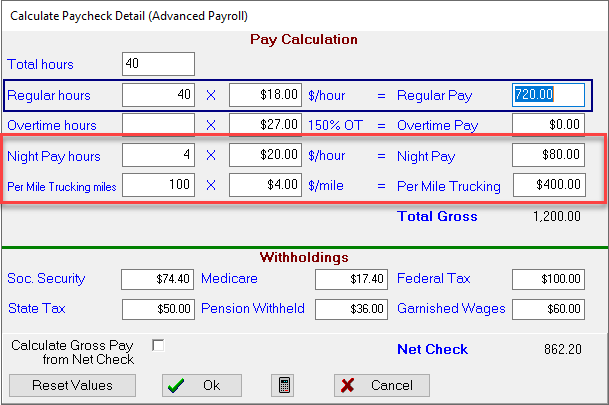

Paycheck Calculations

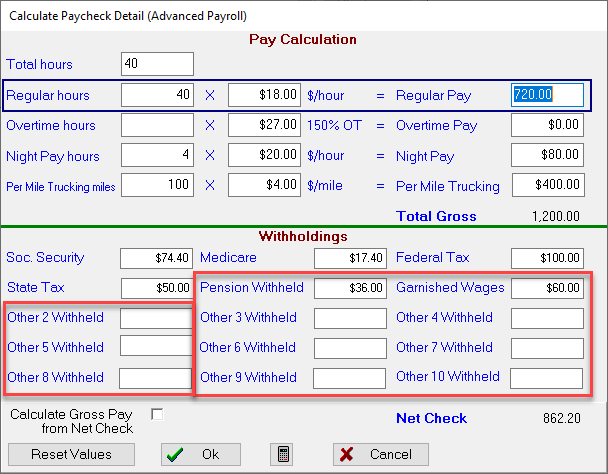

Additional & Custom Withholdings

Advanced Payroll also allows users to customize an additional seven withholding fields for a total of ten. In this example, Garnished Wages was set up as an additional withholding. The boxes named “Other Withheld” can be renamed to whatever needs to be withheld in the Payroll Set Up. Advanced Payroll also allows you to set up and track different types of retirement accounts.